The inspiration behind the book Alex and Sam’s Lemonade Stand by Emmanuel Olowe

Teaching children financial literacy can help their future. Many adults have little or no idea about their finances or how credit works. Inappropriate financial decisions can lead to a lack of understanding, a struggle to save and go into huge debt. Parents and schools that provide children with early financial education will pay in the future. This knowledge enables parents and schools to lay the foundation for their lives to develop sound financial habits and avoid the many mistakes adults make today.

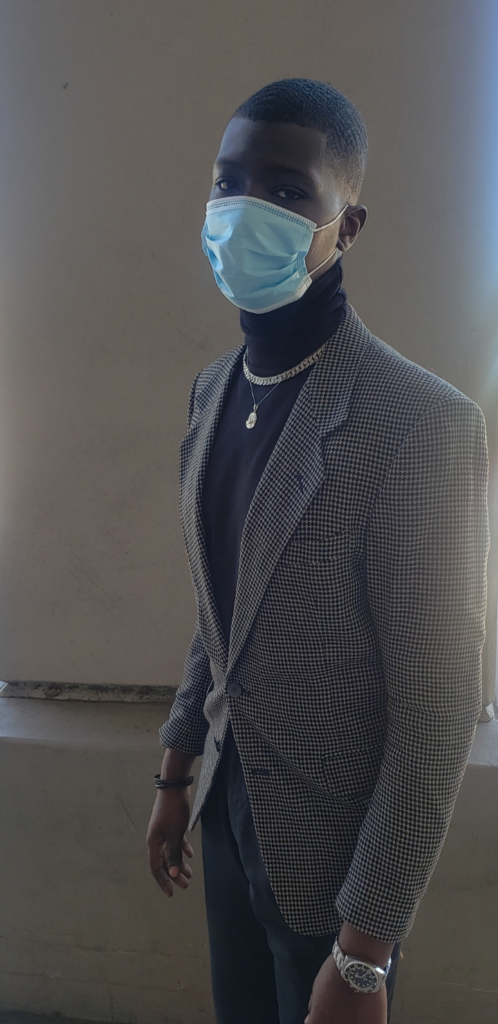

One person who wants to teach children about financial education is a writer and director named Emmanuel Olowe. He wrote a book called Alex and Sam’s Lemonade Stand. The children’s book, to be published in June, aims to help parents teach their children the importance of money.

We wanted to know more about the book, so we partnered with Emmanuel Olowe to find out more.

1. First, introduce yourself.

Hello and thank you for hosting me, my name is Emmanuel Olowe but many people know me only as Manny G. I know mainly cinema but I am also interested in many things related to art. I ran a non-profit organization in Houston and an early learning center in Baytown. They are in the last stages of finalizing a book that will be published in June and aimed at young people.

2. A book will be published in June. Can you tell me more about this book?

The book is called “Alex and Sam’s Lemonade Stand.” It’s about a guy named Alex who sees a skateboard in the store that he’s trying to buy. After Alex’s father teaches him how to start a business, Alex creates a lemonade stand with the help of Alex’s older brother. Running the lemonade stand, Alex learns many valuable lessons about running a business.

3. Why did you choose to write the book?

Encourage people from an early age to learn and understand financial education. I want to grow. I am blessed with the wonderful education I have received, but I have learned little or nothing about financial education with the latest technology touch.

4. Says he chose to write the book because he did not receive financial literacy as a child. How did it affect you?

I have to admit that he bothered me a lot until I was twenty. I had bad shopping habits. I’m also not a big saver and have not invested in stocks, bonds, or cryptocurrencies. I went to a public university and took courses in finance, accounting, and marketing. And even after taking business classes in college, there were still some things I hadn’t learned about financial education. My job is to find out and read financial information. That is why I want to use my platform to educate children about the importance of being financially strong when you know how to use money.

5. How important is it to educate children about the importance of financial education?

It is extremely important to learn the importance of financial education. If parents don’t teach their children how to be financially responsible from an early age, they have to learn the hard and expensive way.